The post Fadata and CellPoint Digital Team Up to Deliver Efficient Payment Operations for Insurers appeared first on The PR Room | Technology PR & IoT PR Agency.

]]>

Fadata and CellPoint Digital Team Up to Deliver Efficient Payment Operations for Insurers.

Specialist insurance software solution provider, Fadata, again demonstrates that its Ecosystem of partners provides convenient, pre-packaged, innovative tools for insurers, partnering with CellPoint Digital to deliver its leading Payment Orchestration solution. Fadata clients will benefit from a seamless integration with CellPoint, gaining access to its worldwide services, including an extensive array of flexible payment options for policyholders and seamless payment of claims.

With the ready-made solution from CellPoint Digital, users of Fadata’s core solution, INSIS, will be able to streamline payment processes to improve efficiency, reduce administrative burden, and enhance overall payment management, all of which ultimately help to improve customer satisfaction.

“We take pride in revolutionising payment operations, empowering clients to thrive in today’s complex financial landscape,” commented Kristian Gjerding, CEO of CellPoint Digital. “Our full stack Payment Orchestration Platform is meticulously engineered to streamline cost while maximising revenue through comprehensive end-to-end capabilities. We look forward to serving Fadata clients and delivering the benefits of efficient payment operations and enabling them to save on operational costs.”

The integration between INSIS and CellPoint links insurers to 28 card schemes, 168 Alternative Payment Methods, and over 200 Acquirers, PSPs & Aggregators, for both incoming and outgoing payments. Insurers also benefit from support for stored cards, pay by link, split payments, instalments, multi-currency, fraud checks and card routing. CellPoint even enables pay-by-link without a requirement for third-party handling. Cutting out the middleman, CellPoint communicates directly with INSIS, so that successful payments trigger automatic policy activations.

Neyko Bratoev, Head of Fadata Ecosystem, commented: “CellPoint’s pre-made payment orchestration within INSIS delivers our clients enhanced digital capabilities that accelerate revenue generation and payouts to the benefit of both insurers and policyholders. We are delighted to welcome CellPoint on as a partner, especially as they share our global design perspective. The extensive integration capabilities and payment methods of CellPoint will help equip INSIS users to expand into new markets with ease.”

Fadata continuously delivers insurers with highly relevant technology, championing innovation to support daily business, as well as future success. With its core solution, INSIS, Fadata sits at the heart of a modern insurance business. Ecosystem provides access to complementary specialist solutions from expert third-party technology partners, all of which can be accessed with ease and efficiency thanks to the flexibility of Fadata’s cloud-enabled SaaS platform. For more information about the technologies and partners expanding the capabilities of Fadata’s core solution for insurers, explore Ecosystem.

-ENDS-

About Fadata

Fadata is a leading provider of software solutions for insurance companies globally. We are on a mission to empower the insurance industry to drive customer engagement, innovation and business value. Together with our customers we are on a journey to build the future of insurance and impact millions of people’s lives every day.

Fadata has clients in over 30 countries across the globe. Headquartered in Munich, with international offices in more than 5 European cities, Fadata is backed by Private Equity Riverside and Lowell Minnick.

For more information, please visit www.fadata.eu

About CellPoint Digital

CellPoint Digital is a fintech leader in payment orchestration. CellPoint Digital’s main solution is a powerful Payment Orchestration Platform that optimises digital payment transactions from cards or alternative payment methods and accelerates the deployment of new payment options. Merchants can easily scale their own payment ecosystem across the world, unify the customer payment experience across their website, mobile apps and other channels, optimise the routing of each transaction, increase conversion rates and minimise payment costs. CellPoint Digital has offices in Copenhagen, Dallas, Dubai, London, Miami, Pune and Singapore. Visit www.cellpointdigital.com to learn more.

Media contact:

Kerri Chard

The PR Room

Email: kerri.chard@theprroom.co.uk

Tel: +44 (0) 333 9398 296

The post Fadata and CellPoint Digital Team Up to Deliver Efficient Payment Operations for Insurers appeared first on The PR Room | Technology PR & IoT PR Agency.

]]>The post Fadata Ecosystem Now Boasts Bdeo Visual Intelligence to Enhance Insurance Processes appeared first on The PR Room | Technology PR & IoT PR Agency.

]]>

Fadata Ecosystem Now Boasts Bdeo Visual Intelligence to Enhance Insurance Processes.

Specialist insurance software solution provider, Fadata, has teamed up with Bdeo to add Visual Intelligence to its pre-made enterprise solution. The latest partner to join the expanding Fadata Ecosystem, Bdeo delivers Fadata P&C clients its Visual Intelligence tool to support automating insurance processes and decision making, paving the way to more agile and successful claims management.

Claims processing is reliant on evidence collection and assessments. Bdeo has digitalised this critical process with the use of AI in image analysis in order to streamline the resolution of claims. By applying AI to claim’s images, Bdeo empowers insurers to make confident decisions at an earlier stage, enabling them to achieve maximum efficiency. Thanks to the Visual Intelligence from Bdeo, Fadata clients can now automate damage assessment and estimate costs within the Fadata core system, INSIS, with greater precision and can even utilise graphic evidence for inspection during policy registration to make more informed underwriting decisions.

Julio Pernía, CEO Bdeo comments: “Using the latest technologies available, insurers have the means to streamline their processes considerably. At Bdeo, we have created Visual Intelligence, using AI and Machine Learning, to simplify processes and expedite decisions making claims processing and underwriting significantly speedier and reducing costs. Insurers can utilize our Visual intelligence tool to ensure that the claims journey is a smooth one, which ultimately strengthens the bond between insurers and their clients.”

Neyko Bratoev, Head of Fadata Ecosystem, comments: “Insurers are committed to delivering high-level customer service and are looking to technology for new, modern ways to help them achieve this. Point-of-claim undoubtedly presents today’s insurers with a golden opportunity to provide positive engagement and experience. We are delighted to welcome Bdeo as an Ecosystem partner, and the opportunity for INSIS clients to introduce the latest Visual intelligence to their claims processes and decision making.”

Fadata’s core system, INSIS, enables insurers to leverage the emerging tech and modern functionalities which are driving insurance into the new digital era, and the agility of the cloud-enabled insurance SaaS platform, not only makes accessing third-party technology simple, but also extremely efficient. Fadata’s Ecosystem provides convenient, seamless access to specialist solutions from best-of-breed technology partners, empowering insurers to engage with innovation and opportunity as insurance customers’ wants and needs evolve. For more information, explore Fadata Ecosystem.

-ENDS-

About Bdeo

Bdeo is an insurtech company founded in Spain in 2017 that develops Visual Intelligence, a specific type of Artificial Intelligence. It helps gather visual evidence of the vehicle or home damage through the smartphone, then analyses it and estimates policy rates or repair costs in seconds. This way, it streamlines motor and home insurance companies’ underwriting and claims management processes, reducing underwriting and claims handling times from weeks to minutes. Bdeo’s technology is present in 25 countries all over the world and 60 insurance companies are already implementing it in their processes.

About Fadata

Fadata is a leading provider of software solutions for insurance companies globally. We are on a mission to empower the insurance industry to drive customer engagement, innovation and business value. Together with our customers we are on a journey to build the future of insurance and impact millions of people’s lives every day.

Fadata has clients in over 30 countries across the globe. Headquartered in Munich, with international offices in more than 5 European cities, Fadata is backed by Private Equity Riverside and Lowell Minnick.

For more information, please visit www.fadata.eu

The post Fadata Ecosystem Now Boasts Bdeo Visual Intelligence to Enhance Insurance Processes appeared first on The PR Room | Technology PR & IoT PR Agency.

]]>The post Matu Assurance Set to Expand as it Selects Fadata Core Solution appeared first on The PR Room | Technology PR & IoT PR Agency.

]]>

Matu Assurance Set to Expand as it Selects Fadata Core Solution.

Insurance company, Matu Assurance is making a giant digitalization leap, selecting Fadata as its insurance core solution provider to fulfil their ambitious digital transformation plans and long-term growth strategy. Matu is looking to expand its offerings and reach a wider client base which will be made much simpler thanks to Fadata’s single core solution, INSIS, supporting all lines of business. Matu welcomes the ability not only to scale, but also to adapt quickly as it focuses on thriving in the dynamic future of insurance.

With four decades of experience, Matu is firmly positioned as an important insurance player. Matu’s aspirations for expansion include serving new customers and a dominating factor in the selection of Fadata was the ability to seamlessly replicate product in new lines of business. The selection decision was also guided by the comprehensive out-of-the-box functionality and best practices that Fadata offers, which was a major consideration for Matu as it looked to reduce the need for extensive customization. With Fadata and INSIS, Matu will enjoy a much more efficient transformation, significantly reduced time-to-market for new products, less training requirements on various new systems as it expands, and the peace of mind that working with a specialised company and mature solution offers.

With Matu’s current business migrated to the new INSIS system in the first instance, Matu can then use the single INSIS platform to expand into new lines of business with ease. Matu Assurance will be utilising recommended Fadata implementation partner, Beakwise, which offers Matu unwavering knowledge of Fadata’s INSIS.

Mr. Khalid Abdelbaki, CEO of Matu, comments: “Implementing a solution that can unify multiple lines of business was a pivotal factor during our selection process. Out-of-the-box coverage is essential for our long-term strategy, and the ease and efficiency of Fadata and its INSIS solution to achieve replication with minimal customization every time we expand, ultimately made selecting Fadata an easy choice. Choosing a solution provider with decades of experience and a proven reliable product fills us with confidence.”

Anders Holm, Chief Commercial Officer at Fadata, comments: “Fadata offers an undeniably powerful solution for companies looking to enter a new digital era of insurance. Our single solution for multiple lines of business delivers out-of-the-box functionality, speedy product replication for expedited deployment and is backed by experienced, insurance industry specific support. We are pleased that Matu values the attributes and agility our INSIS solution has to offer their business and how we can support their business case. We are delighted to welcome a new client as our innovative solution continues to tick all the right boxes for the insurance industry, and we welcome the opportunity to open doors in the Moroccan and African market for Fadata.”

-ENDS-

About Matu Assurance

MATU belongs to professionals in Transport, it was established in1984 and positions itself as a major player in Public Passenger Transport Insurance.

In recent years, the modernized mutual, which turns each insured into an insurer, is determined to converge its businesses and historical organization by placing the policyholder at the center of decisions and by managing the customer experience before, during, and after underwriting.

It has been able to expand its activity, through concentric diversification, towards other branches of insurance, including Automobile Insurance (Individuals), Transport of goods, worker compensation, home, Liability, … in order to provide its customers with a complete, adapted, and personalized experience, while ensuring the best quality & satisfaction.

For more information, visit Matu

About Fadata

Fadata is a leading provider of software solutions for insurance companies globally. We are on a mission to empower the insurance industry to drive customer engagement, innovation and business value. Together with our customers we are on a journey to build the future of insurance and impact millions of people’s lives every day.

Fadata has clients in over 30 countries across the globe. Headquartered in Munich, with international offices in more than 5 European cities, Fadata is backed by Private Equity Riverside and Lowell Minnick.

For more information, please visit www.fadata.eu

Media contact:

Kerri Chard

The PR Room

Email: kerri.chard@theprroom.co.uk

Tel: +44 (0) 333 9398 296

The post Matu Assurance Set to Expand as it Selects Fadata Core Solution appeared first on The PR Room | Technology PR & IoT PR Agency.

]]>The post Oticon Announces Oticon Intent™, the World’s First Hearing Aid with User-Intent Sensors appeared first on The PR Room | Technology PR & IoT PR Agency.

]]>

Oticon Announces Oticon Intent , the World’s First Hearing Aid with User-Intent Sensors.

, the World’s First Hearing Aid with User-Intent Sensors.

Oticon introduces an innovative new hearing aid that can understand a hearing aid user’s listening intentions and respond accordingly.

With the launch of the new premium hearing aid, Oticon Intent, global hearing aid manufacturer, Oticon, is taking the next important step on the journey to solve the No.1 challenge for people with hearing loss – hearing speech in noise. With new groundbreaking 4D Sensor technology, Oticon Intent can understand what users want and need to listen to and adapts the support it provides seamlessly to individual needs.

can understand what users want and need to listen to and adapts the support it provides seamlessly to individual needs.

Our ears gather the sounds around us, but the true hero in sound processing is the brain, constantly working to make sense of sound. Based on this, Oticon’s unique BrainHearing approach to creating technology supports the natural way the brain works. New BrainHearing insights show that head and body movement gives important information about what’s most crucial for hearing aid users to hear at a given moment. These insights powered the development of the new 4D Sensor technology embedded in Oticon Intent, introducing a better way to ensure the brain has all the details it needs.

approach to creating technology supports the natural way the brain works. New BrainHearing insights show that head and body movement gives important information about what’s most crucial for hearing aid users to hear at a given moment. These insights powered the development of the new 4D Sensor technology embedded in Oticon Intent, introducing a better way to ensure the brain has all the details it needs.

While being physically active, it’s necessary to be aware of surroundings to understand them and move around safely. In conversation, users tend to keep their heads still to engage with a single person or move their heads in a group conversation to engage with different people. When struggling to hear what someone is saying, users are likely to lean-in to listen. Oticon Intent combines all these inputs to understand the hearing aid user’s listening intentions and adapt accordingly.

“BrainHearing is central to everything we do because sound is a vital source of stimulation for the brain,” said Thomas Behrens, Vice President of Audiology at Oticon. “If you have a hearing loss, you can actually protect your brain from cognitive decline by using active hearing aids which enable you to connect with others and let you engage in life to the fullest. With Oticon Intent we ensure hearing takes less effort and that you can communicate with ease in any situation. You can also enjoy future-proof, next-generation connectivity technology, crafted into the smallest form factor we have designed to date within this category. We are confident that with Oticon Intent, you will be able to seamlessly engage in life and the digital world like never before.”

Even in challenging, noisy environments, Oticon Intent makes it possible to:

- Move through a crowd with seamless awareness, while orienting to the surrounding sounds.

- Begin chatting with a group of people, thanks to heightened access to voices and balanced background sounds so they are not bothering, while still accessible.

- Start a more intimate conversation with one person, gaining full access to the speaker’s voice amidst the noise all around.

Engage in the digital world like never before

Oticon Intent offers the next generation of Bluetooth® audio, with LE Audio Bluetooth, delivering easy connection to more smart devices* than ever, allowing for a detailed, high quality sound experience for hands-free calls and direct streaming of music, audio book and much more. By double-tapping the Oticon Intent hearing aid, answering calls becomes a simple task. With improved rapid charging, Oticon Intent provides more than a full day’s battery life, after just two hours of charge. The new hearing aids are also ready for future communication technologies such as Auracast broadcast audio.**

broadcast audio.**

To explore this revolutionary hearing aid that helps users to engage in life like never before, visit https://www.oticon.global/oticon-intent

-ENDS-

* Android devices need to have Android 14 and support LE Audio Bluetooth to allow hands-free communication or the Android Protocol for Audio Streaming (ASHA) to allow direct streaming to Oticon Intent. Please visit https://www.oticon.global/compatibility for more information.

devices need to have Android 14 and support LE Audio Bluetooth to allow hands-free communication or the Android Protocol for Audio Streaming (ASHA) to allow direct streaming to Oticon Intent. Please visit https://www.oticon.global/compatibility for more information.

** Android , Google Play and the Google Play logo are trademarks of Google LLC. The Bluetooth® word mark and logos are registered trademarks owned by Bluetooth SIG, Inc. The Auracast

, Google Play and the Google Play logo are trademarks of Google LLC. The Bluetooth® word mark and logos are registered trademarks owned by Bluetooth SIG, Inc. The Auracast word mark and logos are trademarks owned by the Bluetooth SIG. Any use of such marks by Demant is under license. Other trademarks and tradenames are those of their respective owners.

word mark and logos are trademarks owned by the Bluetooth SIG. Any use of such marks by Demant is under license. Other trademarks and tradenames are those of their respective owners.

About Oticon

More than 700 million people worldwide suffer from hearing loss. The majority are over the age of 50 while eight percent are under the age of 18. Oticon’s vision is to create a world where people are no longer limited by hearing loss. A world where hearing aids fit seamlessly into life and help people realise their full potential, while avoiding the health consequences of hearing loss. Oticon develops and manufactures hearing aids for both adults and children and supports every kind of hearing loss from mild to profound and we pride ourselves on developing some of the most innovative hearing aids in the market. Headquartered in Denmark, we are a global company and part of Demant with more than 20,000 employees and revenues of around DKK 20 billion. Changing technology. Changing conventions. Changing lives. Oticon – Life-changing hearing technology. https://www.oticon.global

Media Contact:

Sarah Chard

The PR Room

sarah.chard@theprroom.co.uk

The post Oticon Announces Oticon Intent™, the World’s First Hearing Aid with User-Intent Sensors appeared first on The PR Room | Technology PR & IoT PR Agency.

]]>The post Fadata Partners With DICEUS, Adding Chatbot Solution to Ecosystem appeared first on The PR Room | Technology PR & IoT PR Agency.

]]>

Fadata Partners With DICEUS, Adding Chatbot Solution to Ecosystem.

Fadata, a leading global provider of insurance software solutions, is pleased to announce that DICEUS has become an official partner of the Fadata Ecosystem. The DICEUS AI-powered chatbot, Vitaminise, will deliver Fadata clients excellent customer experience through customized conversational flows and convenient features.

Thanks to a low-code approach to development, Vitaminise Chatbot is a plug-and-play solution that can be implemented and integrated with the existing technology landscape in a few days. It can be adjusted and customized according to the carriers’ business lines, branding, and user journey maps. Conversational flows are structured and sequenced according to the pre-defined scenarios. To assemble a perfect chatbot script, DICEUS CX/UX specialists closely collaborate with a carrier, considering the company’s tone of voice, CTAs, business goals, and user expectations. The chatbot can be integrated with ChatGPT, WhatsApp, Telegram, Viber, Instagram, Facebook, payments platforms, and open data portals.

The AI-powered chatbot solution from DICEUS seamlessly integrates with Fadata’s core system, INSIS. DICEUS and Fadata have built a selection of product packages to suit varying needs. It means clients can select the level of package required according to subscribers, as well as their preferred chatbot flow structure. With the help of the bot, carriers’ clients can buy a policy online, file a claim, find information about the required insurance products and services, and read FAQs. Carriers, in turn, can quickly acquire new customers, launch marketing campaigns for millions of users, and increase revenue by promoting new products and services via the bot. The chatbot developed by DICEUS provokes interest among existing and potential clients, encouraging engagement with the insurance company.

Illia Pinchuk, CEO, DICEUS, comments: “We have partnered with Fadata on many software development projects and are excited to become an official Ecosystem partner with Vitiminise Chatbot. Since DICEUS is focused on, and experienced in tailor-made chatbots for the insurance market, the team is thrilled to join this partnership and help carriers attract more customers by providing convenient features and proactive flows. DICEUS will collaborate with Fadata in integrating Vitaminise Chatbot with the core INSIS processes to deliver the most efficient solutions to Fadata’s customers.”

Neyko Bratoev, Head of Fadata Ecosystem, comments: “Fadata and DICEUS have an excellent established relationship, therefore DICEUS’ knowledge of INSIS makes them a perfect partner for Ecosystem. Vitaminise boasts out-of-the-box specialised insurance flows, which will enable our clients to enjoy a speedier deployment of relevant chatbot functionality, enhancing their digitalisation with the future of customer communications.”

As Fadata continues to announce new innovative, specialist partners, Ecosystem is building into a comprehensive pre-made enterprise solution for insurers. Each new agreement cements the Fadata ideal to provide out-of-the-box software solutions, enabling insurers to deploy new technology capabilities from different trusted companies that share the same forward-thinking ethos. With Ecosystem, insurers are empowered to stay current, react to changing market demands, and innovate into the future as they look to deliver customer-centric developments. For more information, explore Fadata Ecosystem.

-ENDS-

About Fadata

Fadata is a leading provider of software solutions for insurance companies globally. We are on a mission to empower the insurance industry to drive customer engagement, innovation and business value. Together with our customers we are on a journey to build the future of insurance and impact millions of people’s lives every day.

Fadata has clients in over 30 countries across the globe. Headquartered in Munich, with international offices in more than 5 European cities, Fadata is backed by Private Equity Riverside and Lowell Minnick.

For more information, please visit www.fadata.eu

About Diceus

DICEUS is a custom software development company founded in 2011 and headquartered in Lithuania. The company provides custom web and mobile app development, cloud computing services, data warehouse development, and migration. With over 120 projects accomplished, DICEUS has robust experience in various industries, including the insurance sector. The team develops omnichannel digital channels (mobile apps, web portals, and chatbots) for insurance companies and helps integrate them into the organization’s ecosystems.

For more information about DICEUS, please visit https://diceus.com/about/

For more information about Vitaminise Chatbot, please visit: https://diceus.com/solutions/vitaminise/vitaminise-chatbot/

Media contact:

Kerri Chard

The PR Room

Email: kerri.chard@theprroom.co.uk

Tel: +44 (0) 333 9398 296

The post Fadata Partners With DICEUS, Adding Chatbot Solution to Ecosystem appeared first on The PR Room | Technology PR & IoT PR Agency.

]]>The post Digitalization Will Shape the Insurance Industry in 2024 appeared first on The PR Room | Technology PR & IoT PR Agency.

]]>

Digitalization Will Shape the Insurance Industry in 2024.

Digitalization will continue to be the dominant theme in the insurance industry in 2024. Fadata, a leading provider of software solutions for the insurance industry, sees three sweeping trends: the increasing use of Cloud services, the growing use of AI and analytics applications, and the growing importance of digital ecosystems. In addition, the megatrend of sustainability will have a major impact on the insurance industry.

Increasing competitive pressure and changing customer demands are forcing insurance companies to drive digitalization. This includes process optimization and automation, as well as the establishment of new business models. Fadata has identified three key developments and trends to attaining transformation in the industry.

Trend 1: The use of the Cloud

There is a clear Cloud trend in all current modernisation initiatives in the insurance industry, especially in the direction of the public cloud. Using a standard solution in the Cloud offers insurers far-reaching benefits such as agility, flexibility, performance, cost efficiency and scalability. SaaS solutions in particular are becoming increasingly important. They are expected to increasingly replace on-premises environments. Bold and aggressive companies are bypassing a technology generation, choosing to be fast-moving by going straight to the Cloud for the ability to swiftly adapt to market changes and offer innovative services.

Trend 2: The use of AI and analytics applications

The insurance industry is becoming increasingly data-driven. In this context, AI solutions and analytics applications are becoming increasingly important, predominantly driven by the hype surrounding generative AI. They provide the technical foundation for data integration and analysis, including semi-structured and unstructured data such as scanned files. This provides insurers with important and accurate insights.

AI and analytics solutions can help insurers better understand their customers, identify risks, and make more informed decisions to deliver the personalised service that will elevate the industry to ‘caring’. Suddenly tailored and flexible underwriting is enabled, chatbots can provide personalised support to customers, while more targeted advice and offers that are hyper-relevant deliver a more captivating experience. In addition, precise data analytics also support fraud detection and prevention.

AI to date has been talked about a lot, but real world application has been extremely slow in the insurance industry. As insurers look to use data and technology to improve their processes and better serve their customers, insurance should begin to look more intuitive and provide an experience for customers more in-line with services outside of insurance. 2024 is expected to be the year that AI uptake begins to move in a more positive direction, and the industry can finally shift from product-centric to customer-centric.

Trend 3: The use of digital ecosystems

There is also a clear trend towards digital ecosystems in the cloud, which make it easier to link one’s own insurance offerings with those of other service providers. An ecosystem allows insurers to further differentiate themselves and develop innovative offerings that best meet the needs of policyholders.

The insurance industry will therefore increasingly “open up” and build and utilize digital ecosystems, meaning that open rather than closed networks will dominate, including the integration of external partners as part of open insurance models. Such models, characterized by end-to-end processes, flexibility, agility and, above all, openness, will become indispensable for insurers from a competitive perspective, especially in property and health insurance. Above all, open insurance also creates the basis for the implementation of embedded insurance, and it is expected that many more companies will look to capitalize on embedding insurance in their products or services.

Trend 4: Embedding sustainability

Almost all companies today are striving to build a green image – and the insurance industry is no exception. In an era of ESG transparency and increasing sustainability awareness, sustainability will increasingly come to the fore for all insurers. Increasing regulatory requirements, such as the EU’s Corporate Sustainability Reporting Directive, will add to the pressure on insurers to drive the green transformation. In 2024, the industry should begin to deliver on the promises made to date and implement sustainable measures to meet both regulatory and self-implemented goals.

“The insurance industry faces fierce competition and increasing market and customer demands. The challenges ahead can only be met with greater digitalization,” said Anders Holm, Chief Commercial Officer at Fadata. “And new operating models and technologies are inevitably coming into focus. Cloud, ecosystem approaches and AI can be the key enablers for entering a new and, above all, successful era in the insurance industry.”

-ENDS-

About Fadata

Fadata is a leading provider of software solutions for insurance companies globally. We are on a mission to empower the insurance industry to drive customer engagement, innovation and business value. Together with our customers we are on a journey to build the future of insurance and impact millions of people’s lives every day.

Fadata has clients in over 30 countries across the globe. Headquartered in Munich, with international offices in more than 5 European cities, Fadata is backed by Private Equity Riverside and Lowell Minnick.

For more information, please visit www.fadata.eu

Media contact:

Kerri Chard

The PR Room

Email: kerri.chard@theprroom.co.uk

Tel: +44 (0) 333 9398 296

The post Digitalization Will Shape the Insurance Industry in 2024 appeared first on The PR Room | Technology PR & IoT PR Agency.

]]>The post Fadata’s Core Solution for Insurers Now Delivers Seamless Scaling and Rapid Deployment Across Borders appeared first on The PR Room | Technology PR & IoT PR Agency.

]]>

Fadata’s Core Solution for Insurers Now Delivers Seamless Scaling and Rapid Deployment Across Borders.

Fadata’s latest update of its low-code core solution, INSIS, will revolutionise insurance growth. Introducing new business features, upgrades in mere minutes and seamless product replication, enabling enormous potential for insurers to reduce costs and minimise risks.

Fadata continues to demonstrate its commitment to delivering the most up to date core solution for insurers with several key enhancements to INSIS. Following the announcement that Fadata is delivering a completely new low-code process platform for its comprehensive end-to-end insurance solution, Fadata is further building upon its ground-breaking modular architecture. Notably, Fadata’s solution now offers seamless product replication for insurers, enabling rapid deployment and cost-efficiency for global expansion. In true Fadata fashion, the latest INSIS release is designed to deliver an enhanced, flexible solution that offers even more value for clients.

Fadata’s New Multi-Tenancy Feature Reduces Upfront Infrastructure Costs and Boosts Growth

With the latest release of INSIS, Fadata capitalises on the full containerisation of its application to introduce support for multi-tenancy, providing clients the ability to achieve their growth goals with minimal effort, reduced deployment costs and less infrastructure resources. Insurance companies with growth plans can now enjoy the ability to scale across borders and roll out product for different lines of business in a single solution, within a single cloud environment. Not only does this allow for rapid deployment and the ability to scale up and down with demand, but also less reliance upon multiple platforms where insurers can streamline their internal operations in different regions.

Fadata is delivering insurers the ability to copy and adapt products to separate tenants, all of which can be accessed via a shared app, and notably, with separate databases. Multiple instances of business can now be rolled out at an impressive rate. In fact, at least 80% of a product can be replicated in other environments instantly, making deployment both rapid and more efficient. Product configuration is streamlined across all entities while insurers can also enjoy simplified maintenance and more efficient testing processes.

The support for multi-tenancy enables Fadata clients to capitalise on the ability to add new business lines, expand in new territories and simplify acquisitions, removing the heavy upfront investment in infrastructure, not to mention software licenses and maintenance. Insurers operating in multiple countries with distinct entities can offer products across borders with varying premiums and taxes.

Update and add business features with zero disruption

As Fadata continues to optimize operations and provide even greater value to INSIS clients, new features remain high on the agenda. New features, as well as regular updates, are to be introduced through individual module drop releases, ensuring seamless deployment to the running system without disrupting the entire INSIS application. Thanks to containerisation within the modular architecture any adjustments or upgrades can be performed without impacting ‘business as usual’ and can be done so in mere minutes rather than days, weeks, months or even years!

The latest release of INSIS includes:

Reinsurance Automation: Advanced features such as currency fluctuation management, improved index clauses, and efficient claim aggregation are all enabled.

Unit Linked Module Functionality: Fadata has bolstered the Unit Linked module by addressing two crucial aspects which include cost of insurance dynamic calculations and request execution order storage.

Rasmus Lynge, Chief Product & Technology Officer, Fadata, comments: “We continuously develop INSIS, providing our clients with an ever-current solution that enables them to focus on their business as well as plan for the future. We already offer the insurance industry’s most flexible SaaS solution and are consistently unleashing new features that are undeniably the future of digital insurance. Providing the ability to replicate product to support growth underlines our commitment to a highly flexible solution that delivers an abundance of benefits for insurers. Thanks to the decades of experience fuelling our understanding of the industry, we are also proud to be able to say that our clients feel truly confident that we will guide and support them through their digital endeavours.”

To discover more about Fadata and the industry’s most flexible and highly relevant core solution for insurers visit: https://fadata.eu/

-ENDS-

About Fadata

Fadata is a leading provider of software solutions for insurance companies globally. We are on a mission to empower the insurance industry to drive customer engagement, innovation and business value. Together with our customers we are on a journey to build the future of insurance and impact millions of people’s lives every day.

Fadata has clients in over 30 countries across the globe. Headquartered in Munich, with international offices in more than 5 European cities, Fadata is backed by Private Equity Riverside and Lowell Minnick.

For more information, please visit www.fadata.eu

Media contact:

Kerri Chard

The PR Room

Email: kerri.chard@theprroom.co.uk

Tel: +44 (0) 333 9398 296

The post Fadata’s Core Solution for Insurers Now Delivers Seamless Scaling and Rapid Deployment Across Borders appeared first on The PR Room | Technology PR & IoT PR Agency.

]]>The post Oticon is First to Embrace the Revolutionary Audible Contrast Threshold (ACT™) Diagnostic Test to Take on the Number One Challenge with Hearing Loss appeared first on The PR Room | Technology PR & IoT PR Agency.

]]>

Oticon is First to Embrace the Revolutionary Audible Contrast Threshold (ACT ) Diagnostic Test to Take on the Number One Challenge with Hearing Loss.

) Diagnostic Test to Take on the Number One Challenge with Hearing Loss.

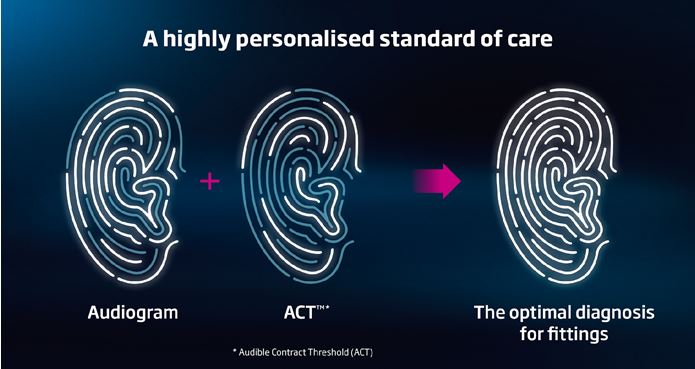

The combination of the new Audible Contrast Threshold diagnostic test, the Oticon Genie 2 fitting software, and Oticon hearing aids is the first hearing care solution to look beyond the audiogram and support hearing care professionals to provide a personalised prescription for hearing in noise, leading to better care and improved outcomes for hearing aid users

Oticon is pleased to announce that it will be the first hearing aid company to incorporate the new Audible Contrast Threshold (ACT ) diagnostic test, invented by Interacoustics Research Unit (IRU), into its Oticon Genie 2 fitting software. The move affirms Oticon’s commitment to supporting hearing care professionals to conduct more personalised and effective hearing aid fittings and ensuring better outcomes for hearing aid users.

) diagnostic test, invented by Interacoustics Research Unit (IRU), into its Oticon Genie 2 fitting software. The move affirms Oticon’s commitment to supporting hearing care professionals to conduct more personalised and effective hearing aid fittings and ensuring better outcomes for hearing aid users.

The problem:

ACT has been developed to address the number one challenge with hearing loss experienced by 1 in 5 of the world’s population: Difficulty hearing speech in background noise. Going beyond the traditional audiogram, the ACT diagnostic test is a significant opportunity for the field of audiology. It will objectively quantify hearing in noise ability for people with or without hearing loss. ACT is a simple, evidence-based method to diagnose hearing in noise difficulties, a well-known challenge for hearing care professionals globally.

The solution:

Thanks to the introduction of ACT, hearing care professionals will have additional diagnostic information to provide a more personalised solution quickly and easily for specific hearing loss and to optimally fit a hearing aid the first time. Through diagnostic integration, the Oticon Genie 2 fitting software will automatically and immediately calculate the optimal amount of help a client needs in noise. Based on the language-independent ACT test which takes an average of 2 minutes to conduct, the software auto-generates personalised help-in-noise settings, providing the correct dose of ‘contrast’ to better separate speech from noise, based on a person’s ACT value. The prescription enables hearing care professionals to fully deploy the advanced capabilities of Oticon hearing aids (Oticon Real and onwards) in the most effective way. The integration is expected to be available in the next release of the Genie 2 fitting software in 2024.

Thomas Behrens, Vice President of Audiology, Oticon comments:

“At Oticon, we have dedicated decades of research into BrainHearing , and have demonstrated the considerable effort for hearing aid users to understand speech in complex noise environments. Hearing aids should support a user to tackle this important challenge optimally and with an ACT assessment, hearing care professionals can ensure our advanced hearing aids do that to the best of their ability. Embracing the new ACT diagnostic test, we are challenging the conventions to explore a new way of working with hearing care and improve the benefit of hearing aids for our users from the first fit. ACT redefines how we can compensate for hearing loss, and we are proud to be the first company to make the introduction and make strong contributions to making it a new industry standard.”

, and have demonstrated the considerable effort for hearing aid users to understand speech in complex noise environments. Hearing aids should support a user to tackle this important challenge optimally and with an ACT assessment, hearing care professionals can ensure our advanced hearing aids do that to the best of their ability. Embracing the new ACT diagnostic test, we are challenging the conventions to explore a new way of working with hearing care and improve the benefit of hearing aids for our users from the first fit. ACT redefines how we can compensate for hearing loss, and we are proud to be the first company to make the introduction and make strong contributions to making it a new industry standard.”

Oticon is renowned for its research into hearing aid technology that can support hearing aid users to thrive in complex listening environments. For the 7 years that ACT has been under development, Oticon has been supporting this research initiative, as well as taken the lead in developing an evidence-based prescription of Oticon hearing aids using ACT values. For the past 2 years, Oticon has worked alongside the IRU team and the Eriksholm Research Centre, also under the Demant umbrella, to clinically trial ACT, heading up the biggest clinical study Oticon has ever conducted, spanning several countries around the world. For more details on the trial, visit: https://www.oticon.global/act

-ENDS-

Media Contact:

Sarah Chard

The PR Room

sarah.chard@theprrroom.co.uk

07779584799

About Oticon

500 million people worldwide suffer from hearing loss. The majority are over the age of 50 while eight percent are under the age of 18. Oticon’s vision is to create a world where people are no longer limited by hearing loss. A world where hearing aids fit seamlessly into life and help people realise their full potential, while avoiding the health consequences of hearing loss. Oticon develops and manufactures hearing aids for both adults and children and supports every kind of hearing loss from mild to profound and we pride ourselves on developing some of the most innovative hearing aids in the market. Headquartered in Denmark, we are a global company and part of Demant with more than 18,000 employees and revenues of around DKK 18 billion. Changing technology. Changing conventions. Changing lives. Oticon – Life-changing hearing technology. https://www.oticon.global

The post Oticon is First to Embrace the Revolutionary Audible Contrast Threshold (ACT™) Diagnostic Test to Take on the Number One Challenge with Hearing Loss appeared first on The PR Room | Technology PR & IoT PR Agency.

]]>The post The MEATER Smart Wireless Meat Thermometer is a Big Deal this Amazon Prime Day – Save 25% appeared first on The PR Room | Technology PR & IoT PR Agency.

]]>

The MEATER Smart Wireless Meat Thermometer is a Big Deal this Amazon Prime Day – Save 25%.

MEATER, the world’s no.1 selling smart meat thermometer brand, is pleased to announce that this Amazon Prime Day (10th-11th October), there will be BIG DEALS on its entire range of meat thermometers. MEATER’s smart kitchen gadget boasts unbeaten quality – just ask the BBQ enthusiasts, cooking influencers and over 30,000 customers on Amazon that rave about it. Now, you can get your hands on one in time for Christmas with 25% off.

MEATER helps you to achieve succulent, tasty meat or fish each and every time and ensures that it is perfectly safe to eat without you having to poke, prod or carve into it to check. Whether you are a gadget loving BBQ enthusiast, budding chef, dinner party host or busy parent that loves to treat your family and friends to a perfectly cooked roast dinner, you won’t want to miss this opportunity to add a MEATER to your collection of culinary gadgets – and with the price carved.

Super smart, the no wires, no fuss MEATER wireless meat thermometer is a desirable gadget that has its own free app featuring a smart guided cook system. It’s not complicated, so you don’t need to be tech savvy to use it, but it is feature-rich, offering plenty of possibilities to experiment with. Simply connect to a mobile smart device and let the delicious creative juices flow. MEATER’s patented smart technology provides estimated cooking times, continuously monitors both ambient and internal temperature whilst meat is cooking and sends alerts to mobile devices when perfection is achieved. It takes away all of the stress of under or over cooked meat and lets you cook any new cut or fish with absolute confidence. This simple to use, must-have culinary gadget is cooking 2.0!

Prime Cuts:

The Original MEATER: 25% CUT TO £74.25 (SRP £99.00).

This wireless smart meat thermometer, with dual temperature sensor, connects with Bluetooth mobile devices within 10 meters.

MEATER Plus: 25% CUT TO £89.25 (SRP £119.00).

All of the bells and whistles of the Original MEATER with an extended 50-meter wireless range. Thanks to a built-in Bluetooth repeater you can monitor your cook from a smartphone or tablet and receive cooking alerts while enjoying more freedom away from your BBQ, smoker or kitchen.

MEATER Block: 25% CUT TO £224.25 (SRP £299.00).

Perfect for the cook and BBQ enthusiast, the MEATER Block stores and charges up to four MEATER Plus probes ready to cook and monitor four delicious meats or fish simultaneously. In addition to access to the MEATER app via Wi-Fi (and Bluetooth to Wi-Fi range extension), these probes also boast Standalone Mode – so if you don’t have Wi-Fi, no problem! A touch control screen allows you to cook easily, with built-in speakers providing audible notifications. MEATER Block also includes numbered probe clips.

MEATER has celebrated over 30million cooks from its users with numbers continuing to grow every day. Check out @MEATERmade, the possibilities are endless.

To find out more about the MEATER range, or if you miss the exclusive Amazon Prime Day discounts, visit MEATER.

-ENDS-

ABOUT MEATER

MEATER was developed to help meat lovers with different cooking skills achieve consistent results when frying or grilling. This fantastic gadget is a must-have for all cooking methods and preparation methods. For more information, please visit http://www.meater.com.

Follow MEATER on Instagram @meatermade, like them on Facebook at @MEATER.

Media contact:

Kerri Chard

The PR Room

Email: kerri.chard@theprroom.co.uk

Tel: +44 (0) 333 9398 296

The post The MEATER Smart Wireless Meat Thermometer is a Big Deal this Amazon Prime Day – Save 25% appeared first on The PR Room | Technology PR & IoT PR Agency.

]]>The post Essex Bulk Services Bolsters Sustainability Credentials with Mission Zero Accreditation appeared first on The PR Room | Technology PR & IoT PR Agency.

]]>

Essex Bulk Services Bolsters Sustainability Credentials with Mission Zero Accreditation.

Family-run transport business with a fleet of 122 vehicles, Essex Bulk Services Ltd (EBS), has achieved Advanced Sustainability Accreditation with Mission Zero, the Quality Standard for the road fleet sector.

EBS recognises that sustainability in the transport sector has an impact on more than simply emission levels. As part of the company’s overall sustainability strategy, and in addition to already completing the Mission Zero Work-Related Road Risk Silver and Gold advanced modules (both recognised by Transport for London as equivalent to FORS Silver and FORS Gold), Essex Bulk Services can now boast Advanced Sustainability under their Mission Zero Accreditation.

As part of the accreditation, Mission Zero provided EBS with a realistic framework for achieving a long-term sustainable transport operation. Joining Mission Zero has influenced the company’s overall sustainability strategy and goals and has heavily contributed to shaping its sustainability initiatives.

In addition to key sustainability elements around vehicles, fuels, and emissions, the Mission Zero Standard and the Mission Zero+ Advanced Sustainability Modules incorporate additional sustainability requirements covering areas such as the reduction of single use plastics, energy efficient devices, health & wellbeing, equality & diversity, the gender pay gap, and much more to ensure a more comprehensive accreditation that also helps the fleet industry to align to the United Nations Sustainable Development Goals (SDGs).

Commenting on why EBS chose to bolster its Mission Zero accreditations by completing Advanced Sustainability, Craig Childs, Director at Essex Bulk Services comments:

“Sustainability is no longer just a corporate social responsibility initiative but a fundamental aspect of long-term success. Embracing sustainability can lead to cost savings, improved brand reputation, enhanced innovation, and long-term resilience. Employees are increasingly looking for employers who prioritise sustainable practices, fostering a sense of purpose and job satisfaction. Engaging employees in sustainable initiatives has helped boost morale, teamwork, and attract and retain talent. In addition, customers are increasingly conscious of their ecological and social impact and prefer to work with businesses that are environmentally and socially responsible.”

Specifically discussing the Mission Zero+ Advanced Sustainability Modules and how they have benefited and supported Essex Bulk Services’ overall sustainability strategy and goals, Childs comments:

“We are committed to the reduction of single use plastics, for example, we have eliminated the use of plastic water bottles and provide reusable water bottles to all our staff members. By making this change, we’re not only reducing our environmental footprint but also showing our commitment to protecting the planet for future generations, as well as ensuring our drivers are always kept well hydrated. We have also donated 20 trees to the National Trust as part of our ongoing sustainability strategy, helping towards making a positive impact on the environment. Operationally we have benefited by reducing our co2 emissions and exploring alternative fuel, HVO.”

Mission Zero is the UK’s fastest growing fleet accreditation scheme. Through its alignment to the United Nations Sustainable Development Goals (SDGs), Mission Zero has redefined the meaning of sustainability in fleet accreditation standards and provides companies with a realistic pathway to achieving long-term sustainability.

Nick Caesari, CEO, Mission Zero comments: “Mission Zero is helping companies of all sizes to achieve a sustainable future. Congratulations to the entire EBS team on their Sustainability Accreditation, we are incredibly proud to have Essex Bulk Services as part of the Mission Zero family.”

-ENDS-

About Essex Bulk Services

Essex Bulk Services is a family-run transport business committed to providing safe and reliable transportation services. Established in 2012 by the Childs family, the company has grown from a small operation to a reputable and trusted name in the industry.

Essex Bulk Services is proud of its family values and the commitment it has to health and safety. Its goal is to deliver exceptional transportation services while ensuring the well-being of all those who interact with the business. Safety will always remain EBS’s top priority as it continues to grow and serve the community.”

About Mission Zero

Mission Zero is one the UK’s leading fleet accreditation schemes supporting fleet operators in achieving zero collisions, zero emissions and zero prohibitions.

Designed for all vehicle types, Mission Zero is based on a full legal compliance audit but also incorporates industry best practice and contractual requirements. Recognised by Transport for London, CLOCS, HS2, as well as other leading specifiers, Mission Zero provides fleet operators with a single path to meeting both legal and contractual requirements, meaning they no longer have to join multiple accreditation schemes to cover all aspects.

For more information, and to register free of charge for access to their complimentary supporting document portal ‘Mission Zero Accreditation Portal’ (MZAP), please visit www.missionzero.org.uk

Media contact:

Sarah Chard

The PR Room

Email: sarah.chard@theprroom.co.uk

Tel: +44 (0) 333 9398 296

The post Essex Bulk Services Bolsters Sustainability Credentials with Mission Zero Accreditation appeared first on The PR Room | Technology PR & IoT PR Agency.

]]>